War, inflation, interest rates, looming recession…

2022 is one of the worst years in recent times.

In this article, I will be covering:

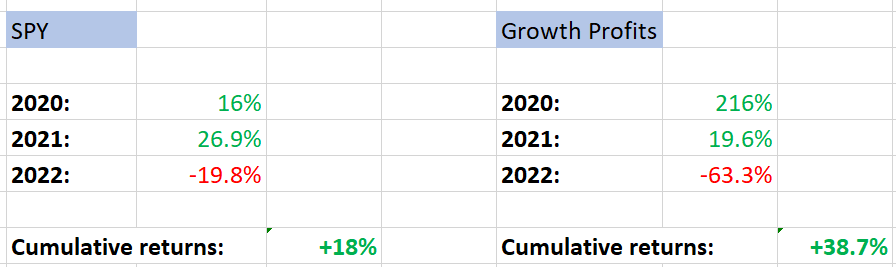

2022 P/L Performance

3 Biggest Learnings of 2022

Thoughts on Tesla & Twitter

2022’s Performance

Down -63% is no fun. It’s sucks.

This is also my first red year for me since I started investing seriously & tracking my P/L in 2017.

I am aware though, this is what I signed up for.

A portfolio with a growth mandate will have high P/L swings both to the upside, & to the downside.

As my portfolio is concentrated on Tesla, most of the losses are due to Tesla’s stock price making new lows in recent months. More on this below.

As 2022 comes to a close, these are my reflections & learnings:

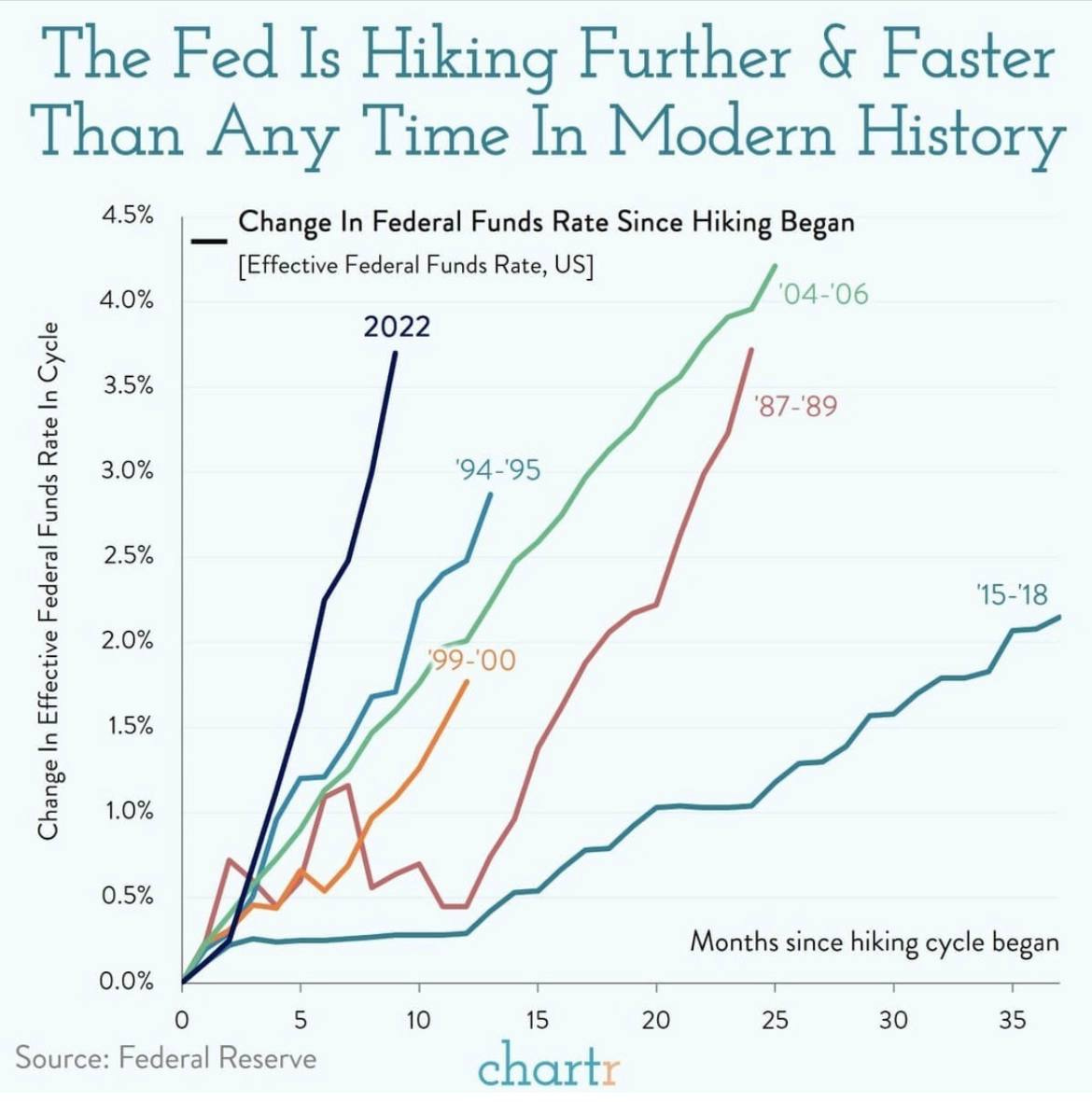

1. Don’t Fight the Fed

The pace of the rate hikes in 2022 is insanely steep. (dark blue line on the graph above)

Fed controls the narrative more than ever right now.

In 2020, despite Covid at its worst, the Fed can make markets rebound & move to new highs with their stimulus packages.

In 2022, the Fed also cause markets to crash sharply by increasing interest rates faster than at any time in history.

My Takeaway:

Fed controls market movements more so now than ever. At least in the short term.

Not taking account of the Fed for my portfolio decision-making, is perhaps too rigid (as opposed to being consistent).

Being a good investor is knowing to adjust when needed.

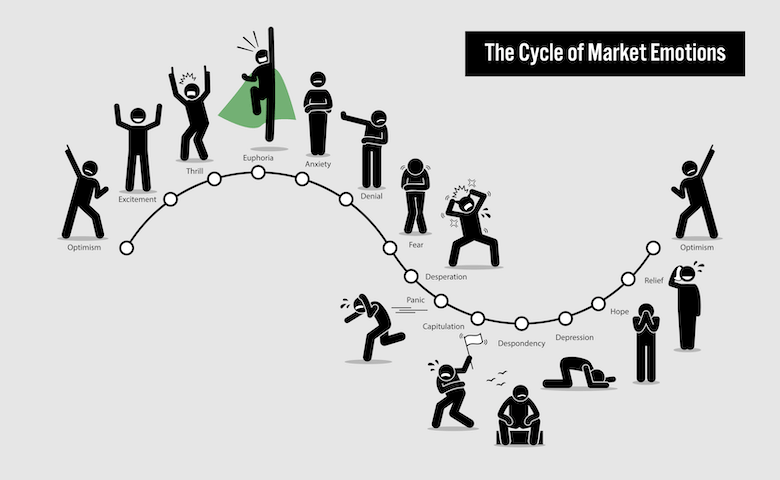

2. Pay more attention to Sentiments

One of the things I should have done was give more attention to “Reverse Indicators”.

Example 1:

In Early 2022, the Fed was saying everything is under control, inflation is transitory…

Meaning: Shit is hitting the fan soon, time to get out

For big macros, nothing is ever under control. I should have realized something big is brewing underneath.

Example 2:

At the market’s peak during late 2021, everyone & their grandma was buying.

FOMO (Greed) was very high.

Meaning: A bubble might be bursting soon.

Be fearful when others are greedy. But I didn’t enough pay attention to what others were doing.

These are just two examples.

Connecting the dots:

When these indicators are used together, they are actually a reliable signal that I should have risk-off some during late 2021.

Looking back, when everyone was greedy in late 2021 & valuations were lofty, I didn’t get fearful. That’s probably a mistake in hindsight.

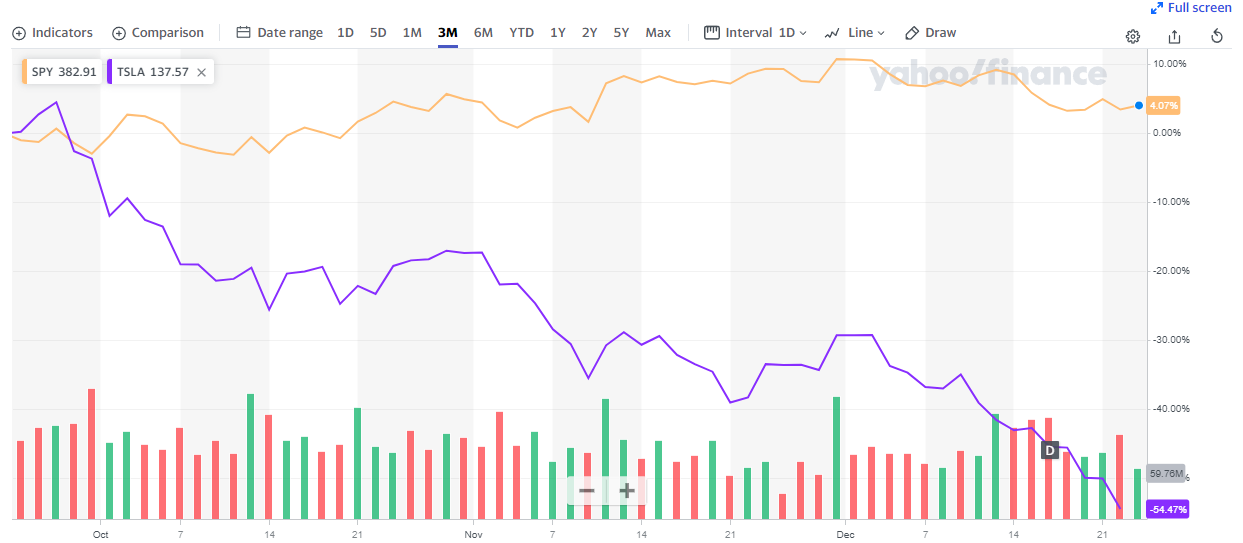

3. Underestimated Twitter Drama

This -50% drop in Tesla was not due to the Macros.

Because the S&P would have dropped too, but it held up well.

This big drop is mainly due to Elon taking over Twitter:

At first, I thought it was just a $44B purchase. The saga will be over once Elon is done buying Twitter.

Obviously, the repercussions & implications are far-reaching and wider than I initially expected.

Elon Musk needs to sell more Tesla shares to keep Twitter afloat.

Elon is adamant about exposing corruption in America’s highest echelon.

(Read up on the Twitter X Files)

I feel the second point has a bigger risk impact, and increase variables & uncertainty.

Key-man Risk:

Powerful & influential men will not sit idly and do nothing when they are attacked.

They will fight back. There will be plots against Elon & his allies.

Many great men were harmed because they didn’t handle politics adequately.

To use a historical context:

Great men like Yue Fei, Julius Caesar, and JFK were killed.

Not from external enemies, but internal ones.

The biggest geopolitical risk for Elon & Tesla, therefore, is not from outside eg. China or Russia.

But from within.

Before:

Before the Twitter saga, the “key-man risk” was Elon anyhow tweet or say things, causing share price to drop temporarily in the short-term.

I understand that’s part of Elon’s eccentric personality. And as a long-term investor, I am okay with that.

Now:

I feel that’s a higher risk factor with Elon. And this risk probably will only increase in years to come.

As a human being, I applaud what Elon is doing. For humanity’s future, it’s the right thing to do.

As a Tesla shareholder, I need to re-evaluate this increased risk. Especially as Tesla is a concentrated position in my portfolio.

To be clear, I still think Tesla is one of the best companies to own, even in today’s climate & after everything that has happened.

I have not sold a single Tesla share this year, nor do I plan to sell any shares.

But I will make certain adjustments to my portfolio for 2023.

More on that in a separate post.

To wrap up, these are some of my insights for the year.

Takeaways:

Fed controls markets even more than ever in the short term

Use more “reverse indicators” for my portfolio decisions

Increased key-man risk for Tesla

In the next article, I will share my 2023 Game Plan.

Be sure to subscribe to be notified!